Set Up Gift Aid for Donations

Gift Aid is a UK government scheme that allows charities to reclaim 25% of a donation from HMRC, provided the donor is a UK taxpayer.

To enable Gift Aid for donations, go to Ecommerce > Charity Donations > Donation Settings.

If you are already logged in to your account, you can click on the following link to access the payment settings page directly:

admin.littleboxoffice.com/charity-donations

admin.littleboxoffice.com/charity-donations

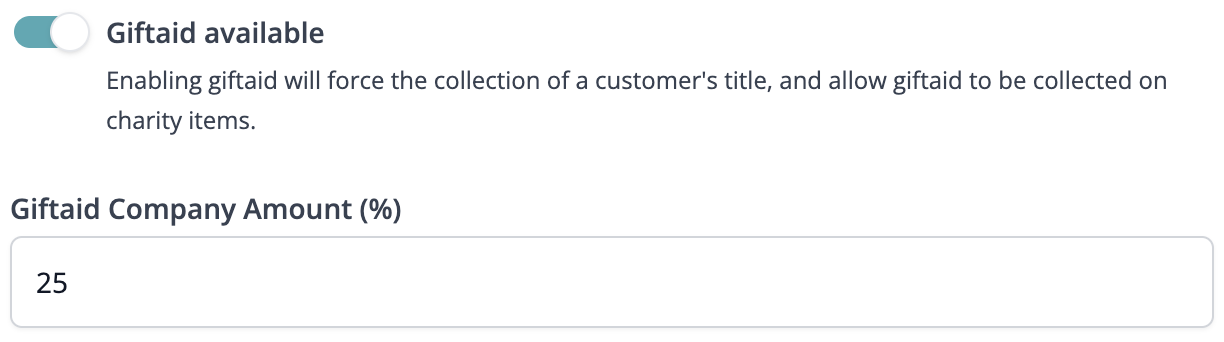

1. Enable the Giftaid available option

Enter 25% in the corresponding field (value set by the UK government and may change in the future).

2. Configure Gift Aid for a charity

When creating or editing a charity in the system, locate the Gift Aid toggle (immediately under the pricing box).

• Enable Gift Aid for the specific charity.

• Ensure that each donation variant under the charity has Gift Aid enabled individually.

3. Configure Gift Aid for an event

If a charity is linked to a specific event, enable Gift Aid at event level. This will ensure that Gift Aid is applied only to donations made within that event.

Remember: once Gift Aid is enabled at the company level, the system will request address details for all donations.

4. Customise the Gift Aid Declaration Text

Website > Text Manager > Category > GiftAid Declaration

If you want to modify the declaration text displayed to the customer you'll need to do it from the Text Manager Module.

5. Reports

• The Gift Aid Amount column is available in reports.

• The system helps charities track donations that qualify for Gift Aid.

Important: the charity is responsible for reclaiming the 25% Gift Aid amount from the UK government; we only facilitates data collection.

6. Customer Checkout Experience

1. Customers add a donation to their basket.

2. Upon proceeding to checkout, they will see the Gift Aid Declaration Page

3. The system prompts them to provide necessary address details (mandatory for Gift Aid eligibility).

4. They must tick a box to confirm their Gift Aid declaration.

5. The donation is processed, and the relevant details are stored for the charity to reclaim the Gift Aid amount from HMRC.

Related Articles

Additional enhanced features

Your account has been set up with all the default features you need to successfully run your box office. However, our new system also offers several highly enhanced features. Read about them below. If you wish to enable any of these features, simply ...Add booking fees

To cover your costs or increase your income, you can set up your own 'booking' fees. (Our fees are set automatically and visible when editing any sale item (e.g. tickets); you can decide to absorb or add them to the sale item price.) The following ...Pre-made and custom reports

The reports section features numerous pre-made reports which you can use just as they are. However, everyone has different needs and it is expected that these pre-made reports will not meet all your requirements. This is why all these reports can be ...Why your event is showing as sold out

This article helps you identify why an event may appear as Sold Out, and guides you through the key settings to check so you can quickly resolve the issue. What to Do if Your Event Status Is Sold Out or Off Sale If your event is unexpectedly showing ...Creating Discount Codes

You can create and manage discount codes to offer special promotions on your events or products. Follow the steps below to create and configure discount codes. Creating a Discount Code 1. Navigate to Basket Codes From the left-hand menu, go to ...